Blog Archives

Aker Solutions to Design World’s Largest Spar Platform for Statoil

Aker Solutions has been awarded a FEED (front-end engineering and design) contract from Statoil to design the world’s largest Spar platform for the Aasta Hansteen field development in the Norwegian Sea.

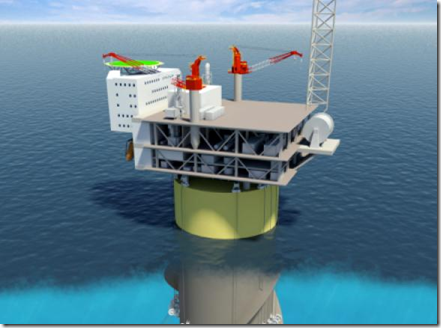

With a total hull length of 193 meters and a draught of 170 meters, the Aasta Hansteen (formerly named Luva) Spar platform will be the largest of its kind. A Spar platform is a cylinder shaped floating offshore installation. Aasta Hansteen will be the first Spar platform on the Norwegian continental shelf (NCS), and also the world’s first Spar platform with condensate storage capacity – a so called Belly-Spar.

The Belly-Spar concept is an exclusive Aker Solutions design. The ‘belly’ refers to the increased diameter on part of the circular shaped hull, where the condensate storage tanks are located. This gives the Aker Solutions’ Belly-Spar its characteristic shape.

Henning Østvig, head of Front-End & Technology in Aker Solutions says: “The Aasta Hansteen Spar will be the first production platform on the NCS with steel catenary risers. With a water depth of 1300 meters, this is probably the only riser technology that can meet the challenges on the Aasta Hansteen field”.

The steel catenary risers are made of self-supporting steel pipes in a bow shape between the platform and the seabed. The shape helps the risers compensate for the motions on the floating facility.

Innovation

“The Belly-Spar concept is a result of the innovative spirit and culture among our engineers, who have come up with the right solutions for the challenging conditions on the Aasta Hansteen field,” says Valborg Lundegaard, head of Engineering business area in Aker Solutions.

The mooring system for Aasta Hansteen Spar platform consists of a set of polyester lines. “There are currently no installations on the NCS with polyester mooring. Aasta Hansteen may be the first, and it will definitely be operating in the deepest water,” says Henning Østvig.

The FEED study will be completed in the third quarter of 2012. The contract value is undisclosed.

Aasta Hansteen

The field was discovered in 1997 and lies 300km offshore in the Vøring area. The licence partners are Statoil (75 per cent), ExxonMobil (15 per cent) and ConocoPhillips (10 per cent).

Aker Solutions’ contract party is Aker Engineering & Technology AS.

Related articles

- USA: Aker Solutions to Provide Umbilicals for Anadarko’s Lucius Development (mb50.wordpress.com)

- Aker Solutions wins NOK 1 Billion Contract to Upgrade Snorre A Drilling Facilities (gcaptain.com)

- USA: Aker Solutions to Open Hi-Tech Drilling Equipment Simulator in – Houston (mb50.wordpress.com)

- Norway: Aker Solutions Delivers Subsea Templates for Skuld Fast-Track Development (mb50.wordpress.com)

- Aker Solutions to Deliver 6 More Trees to Statoil’s Giant Troll (gcaptain.com)

- Ghana: Aker Solutions Signs Well Service Contract with Tullow (mb50.wordpress.com)

- Norway: EMAS AMC Wins Fram SURF Deal from Statoil (mb50.wordpress.com)

Ichthys: The Largest Subsea Gig for McDermott (Australia)

McDermott International, Inc. announced today that its Australian subsidiary has received and signed a letter of award for the Ichthys Gas-condensate Field Development subsea umbilical, riser, flowline (“SURF”) project by INPEX. The contract value is in the order of magnitude of US$2 billion and is the largest subsea contract McDermott has been awarded to date.

This project includes engineering, procurement, construction, installation (“EPCI”) and pre-commissioning of production flowline systems, a MEG injection system, plus start-up condensate transfer and fuel gas transfer flowline systems, control systems as well as other associated SURF elements in water depths up to 275 meters. McDermott will also install mooring systems for the Floating Production, Storage and Offtake vessel and Central Processing Facility as well as installation engineering for future flowlines, risers and umbilicals.

McDermott has already begun engineering and procurement work and is expected to start fabrication of more than 16,000 tonnes of subsea equipment, including a subsea Riser Support Structure and installation aids, at its Batam Island, Indonesia fabrication facility beginning in 2013. The complex offshore installation campaign will see McDermott undertake the installation of subsea hardware, moorings, risers, umbilicals and flowlines utilizing its specialty subsea vessels Emerald Sea and North Ocean 102. McDermott is working with Heerema Marine Contractors (“Heerema”) for transportation and installation of a portion of the offshore scope, utilizing the heavy lift, J-Lay and Reel-Lay capability of Heerema’s new-build vessel Aegir.

Stephen M. Johnson, Chairman of the Board, President and Chief Executive Officer, McDermott said, “McDermott has a long track record working on EPCI projects offshore Australia. This major SURF award firmly endorses McDermott’s core EPCI competencies and our competitive subsea construction vessels, combined with Heerema’s installation strength and the team’s alignment with INPEX. This is a large scale and complex development, and we are firmly behind promoting the success of this LNG project.”

The Ichthys LNG Project is a Joint Venture between INPEX (76%, the Operator) and Total (24%). Gas from the Ichthys Field, in the Browse Basin approximately 200 kilometers offshore Western Australia, will undergo preliminary processing offshore to remove water and extract condensate. The gas will then be exported to onshore processing facilities in Darwin via an 889-kilometer subsea pipeline. The Ichthys LNG Project is expected to produce 8.4 million tonnes of LNG and 1.6 million tonnes of LPG per annum, along with approximately 100,000 barrels of condensate per day at peak.

Articles

- Australia: Osaka Gas Co. Takes 1.2 pct Ichthys Project Stake

- Australia: All Ichthys Approvals on Track, INPEX Says

- Australia: Ichthys FID Tomorrow? Tokyo Gas Secures Equity Interest

- Holiday Season Could Delay Ichthys FID, Inpex Says

- Australia: INPEX, Total Sell All LNG from Ichthys Project

Related articles

- Australia: Saipem Lands Ichthys LNG Work (mb50.wordpress.com)

- Australia: All Ichthys Approvals on Track, INPEX Says (mb50.wordpress.com)

- Total and Inpex Launch $34 Billion Ichthys LNG Project Offshore Northwestern Australia (gcaptain.com)

- Australia: Ichthys Cost to Exceed USD 30 Billion, Total CEO Says (mb50.wordpress.com)

- Ichthys LNG Project (jobcontax.wordpress.com)

Gulf of Mexico Records Largest Demand for Specialised Offshore Vessels

Infield Systems have made a report on the offshore construction activity demand in order to recognize key regions and gauge supply developments stressing the possibility for activity increase due to the arrival of transcontinental pipelines and the deepwater tie-in of various satellite wells matched to an increased level of subsea installations. Demand is expected to reach its peak during 2015.

North America, particularly the Gulf of Mexico (GoM), has been recording the largest demand level mainly because of the availability of assets.

A considerable growth is expected in Asia and West Africa to 2016, supported by West African projects perceived as one of the key constituents of the emergent deepwater market and the region is seen as a key to a continued utilization of strategic assets. The Asian market features numerous countries including Malaysia, India, China and Indonesia, each reflecting differing dynamics, providing a slightly different opportunity for vessel operators who are keen to secure high utilization.

The global recession has affected all offshore developments and oil companies forcing them to restructure their capital cost commitments together with their offshore expansion plans.

Considerable confidence in Global financial markets has been regained. The declining oil price trend seen in Q2 2011 stabilized during Q3 2011. Greatly depending on whether the major economies return to recession, the global oil demand is anticipated to grow, although at a slower rate than expected.

Infield Systems strongly believe that the level of activity for specialist vessels will increase as E&P ventures expect to rise as a result of exploited reserves.

Vessel operators dealing with harsh and remote environments are most likely to be at the forefront of the expected growth. However, Infield Systems expects the global fleet to become more technologically advanced.

Infield Systems’ Global Perspective Specialist Vessels Market Report To 2016 is dedicated to the construction and construction support vessels that are employed in the development of offshore oil and gas fields. The third edition of this ground breaking report provides an in depth analysis of global and regional trends and the supply and demand dynamics for the period 2007 through to 2016.

Related articles

- Oceaneering Bags Angola Gig from BP (mb50.wordpress.com)

- USA: Harvey Gulf Orders CAT DEP Generators for SV-310 Offshore Vessel (mb50.wordpress.com)

- UK: Reef Subsea Enters Charter Deal for Two Neptune Offshore’s Vessels (mb50.wordpress.com)

- Westshore Shipbrokers: Ultra-Deepwater, What is Next for the Shipowner? (Brazil) (mb50.wordpress.com)

- USA: Aker Solutions to Provide Umbilicals for Anadarko’s Lucius Development (mb50.wordpress.com)

- USA: Hess to Splash USD 6.8 Billion in 2012 (mb50.wordpress.com)

- C. G. Glasscock Drilling Company offshore mobile drilling platform “Mr. Gus II” (mb50.wordpress.com)

- HOS Centerline gives new meaning to multi-purpose vessel (mb50.wordpress.com)

UK: Largest Contract in Odfjell Drilling’s History

Odfjell Drilling has been awarded a significant pre-contract award with BP for the provision of a new build, semi-submersible drilling unit for use in the UK’s West of Shetland region. The contract value is approximately $1.2 billion, excluding options, and represents the largest contract in Odfjell Drilling’s 40 year history.

The new unit will be involved in drilling in the Schiehallion and Loyal fields and will form a key part of the Quad 204 development. The full contract, which is subject to approval by the Quad 204 Partnership, will have a fixed duration of 7 years and is due to start in Q4 2014.

In July 2011 BP announced a decision to progress a major re-development of the Schiehallion and Loyal oil fields to the west of the Shetland Islands.

Schiehallion and Loyal have produced nearly 400 million barrels of oil since production started in 1998 and an estimated 450 million barrels of resource is still available. The investment of circa £3 billion in the re-development of the fields will take production out to 2035 and possibly beyond.

President & CEO of Odfjell Drilling, Simen Lieungh states:

“This contract award from BP is of great importance and represents a solid contribution to the company’s further growth and is a recognition of Odfjell Drilling’s status as a reputable international drilling contractor. We have a track record of delivering new build units on time and on budget and this new build for BP will be the fifth new deep water unit for the company. We highly value our relationship with BP and look forward to developing this relationship further in the future.”

Jim Cowie, BP Vice President for Wells, said: “The Quad 204 partnership is making this major investment in its drilling capability in response to high future demand West of Shetland and a desire to invest in the latest equipment that can help deliver its business plans. This is an exciting development and one which builds on BP’s recent announcements concerning its investments in the North Sea. Odfjell Drilling is a safe, efficient and innovative drilling contractor that is performing well for BP in the North Sea and with Deepsea Stavanger offshore Angola.”

Fifth deepwater unit delivery

The new state of the art Sixth generation rig will be built in South Korea by Daewoo Shipbuilding & Marine Engineering (DSME).

“The new rig for BP is of the enhanced GVA7500 harsh environment design and will be a sister rig of the Deepsea Atlantic and Deepsea Stavanger previously delivered to us by DSME. We are pleased to continue our collaboration with DSME, says Mr. Lieungh.”

Construction engineering has commenced and keel laying is scheduled for March 2013.

Articles

- UK: Hamworthy to Supply IGG Package for Quad 204 FPSO

- UK: BP, Partners Approve Major Re-Development of Schiehallion and Loyal Oil Fields

- USA: KBR to Perform Engineering Design Support for BP Quad 204 FPSO Project

- BG Group Contracts Deepsea Metro I Drillship for Campaign Offshore Tanzania

- Norway: Odfjell Drilling, Statoil Sign Contract for “Deepsea Bergen” Oil Rig

Related articles

- South Korea: Naming Ceremony for Odfjell Drilling’s New UDW Drillship (mb50.wordpress.com)

- South Korean Hyundai Heavy Delivers Deepsea Metro II Drillship (mb50.wordpress.com)

- Deep Sea Metro Takes Delivery of Second Drillship (gcaptain.com)

- Deepsea Metro II Drillship Arrives in South Africa (mb50.wordpress.com)

- Ophir Begins with Drilling Operations Offshore Tanzania (mb50.wordpress.com)

- Dolphin Drilling to Provide Two Drillships for Anadarko’s Mozambique Operations (mb50.wordpress.com)

- BP, Shell to partake in arctic drilling inquiry, Telegraph says (mb50.wordpress.com)

- Oceaneering Bags Angola Gig from BP (mb50.wordpress.com)

Norway: Aldous/Avaldsnes One of Largest Discoveries Ever, Statoil Says

Statoil ASA , together with partners Petoro AS, Det norske oljeselskap ASA and Lundin Norway AS, has confirmed significant additional volumes in its appraisal well in the Aldous Major South discovery (PL265) in the North Sea.

The results of appraisal well 16/2-10 have increased production license PL265 estimates to between 900 million and 1.5 billion barrels of recoverable oil equivalent.

This is a doubling of the previously announced PL265 volumes of between 400 and 800 million barrels of oil equivalent.

It has previously been confirmed that there is communication between Aldous in PL265 and Avaldsnes in PL501, and that this is one large oil discovery.

“Aldous/Avaldsnes is a giant, and one of the largest finds ever on the Norwegian continental shelf. Volume estimates have now increased further because the appraisal well confirms a continuous, very good and thick reservoir in Aldous Major South,” says Tim Dodson, executive vice president for Exploration in Statoil.

Final data show that the oil column in appraisal well 16/2-10 is approximately 60 metres. These data also confirm that the reservoir is of the same, excellent quality as in the Aldous Major South discovery well 16/2-8. This is the main reason for the substantial upward revision of PL265 volumes.

The Aldous/Avaldsnes discovery extends over a large area of approximately 180 square kilometres, and there is considerable variation in both reservoir thickness and oil column height in the structure. Additional appraisal wells will be drilled in both licenses.

Statoil will await the results from these wells before providing updated and more accurate volume estimates for the combined discovery.

After completion of the appraisal well, the Transocean Leader drilling rig will move to the Troll field in the North Sea.

Aldous Major South is situated in production license PL265 in the North Sea, and appraisal well 16/2-10 was drilled 4.2 kilometres north of the 16/2-8 discovery well.

Statoil is the operator and has a 40% interest in PL265. The partners are Petoro AS (30%), Det norske oljeselskap ASA (20%) and Lundin Norway AS (10%). Well 16/2-10 is the seventh exploration well in PL265. The license was awarded in the North Sea Awards 2000.

Avaldsnes is located in production licence PL501. Lundin Norway AS is the operator with a 40% interest, while partners Statoil and Maersk have 40% and 20% interests, respectively.

Related articles

- Statoil Doubles North Sea Estimates (online.wsj.com)

- Norway oil, gas find may be its third biggest (theglobeandmail.com)

Continents of the World

Continents of the World