Category Archives: Lucius

Located in the Gulf of Mexico on Keathley Canyon Block 875 (Lease OCS-G-21444) in a water depth of 7,126 feet (2,172 meters) is the Lucius oil and gas field.

Worldwide Field Development News May 3 – May 9, 2014

| This week the SubseaIQ team added 6 new projects and updated 29 projects. You can see all the updates made over any time period via the Project Update History search. The latest offshore field develoment news and activities are listed below for your convenience. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gulf of Mexico: INPEX Buys Lucius Stake (USA)

INPEX CORPORATION has through its subsidiary, Teikoku Oil (North America) Co., Ltd., it has agreed to acquire a 7.2% participating interest in the Lucius project which includes portions of Keathley Canyon blocks 874, 875, 918 and 919 in the deepwater of the U.S.Gulf of Mexico, from a subsidiary of Anadarko Petroleum Corporation (Anadarko), an American independent oil and natural gas exploration and production company.

After the joint venture agreement is finalized, the Lucius project will continue to be operated by Anadarko with a 27.8% participating interest, with the following companies participating:

Plains (23.331%), Exxon Mobil (15%), Apache (11.669%), Petrobras (9.6%), INPEX (7.2 %) and Eni (5.4%).

The Lucius project is located offshore approximately 380km southwest of Port Fourchon, Louisiana with a water depth at approximately 2,160m. Anadarko and co-venturers made a Final Investment Decision (FID) to develop this project in December 2011, and the first production of crude oil and natural gas is expected to start in the latter half of 2014.

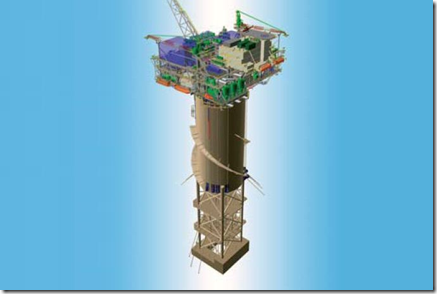

Crude oil and natural gas pumped from the Lucius project will be processed with a truss spar floating facility (Spar) with the capacity to produce in excess of 80,000 barrels of oil per day and 450million cubic feet of natural gas per day. Processed crude oil and natural gas will then be exported to the onshore facilities in Louisiana via a subsea pipeline.

INPEX has participated in oil and gas development projects in the shallow waters of the U.S. Gulf of Mexico. In February 2011, INPEX also participated in the Walker Ridge 95/96/139/140 Blocks in the deepwater U.S. Gulf of Mexico. The participation in the Lucius project will enhance INPEX’s experience and expertise of the operation in the deepwater projects and contribute to continuous enhancement of its E&P activities as one of the measures for growth as described in “Medium- to Long-Term Vision of INPEX.”

INPEX will be expanding its exploration, development and production activities in the U.S. Gulf of Mexico.

INPEX Buys Lucius Stake (USA)| Offshore Energy Today.

- McDermott Bags Offshore Installation Gig in U.S. GOM (mb50.wordpress.com)

- USA: Statoil Secures 26 New Leases in Gulf of Mexico (mb50.wordpress.com)

- WWCS, DOF Subsea Conduct Subsea Services in US Gulf Of Mexico (mb50.wordpress.com)

Technip Wins Lucius Field Contract from Anadarko

Technip reported Thursday that it has been awarded a lump sum contract by Anadarko Petroleum Corporation for the development of the Lucius field, located in the Keathley Canyon area of the Gulf of Mexico at a water depth of approximately 7,000 feet (2,130 meters).

The contract covers:

- installation of a flexible flowline, multiple flexible gas lift jumpers, main gas lift and infield umbilicals, subsea distribution units, electrical, fiber optic and hydraulic flying leads.

- design and fabrication of the flexible flowline end termination.

- fabrication and installation of rigid jumpers.

- burial of flowlines.

- flooding and hydro-testing of the flowline system.

Technip’s operating center in Houston, Texas, will perform the overall project management.

This contract constitutes a significant milestone in Technip’s recent acquisition of Global Industries as it will utilize a number of Global Industries key assets along with the Deep Blue, one of Technip’s deepwater pipelay vessels, during the offshore installation phases in 2013 and 2014.

Related articles

- USA: FMC Technologies Provides Subsea Systems for Anadarko’s Lucius Field (mb50.wordpress.com)

- USA: Aker Solutions to Provide Umbilicals for Anadarko’s Lucius Development (mb50.wordpress.com)

- Anadarko Successful at Barquentine-4 Well, Offshore Mozambique (mb50.wordpress.com)

- Norway: North Sea Giant Stays with Technip (mb50.wordpress.com)

- Australia: Technip Wins Wheatstone Platform Design Contract from DSME (mb50.wordpress.com)

Technip USA Orders Deepwater Mooring Ropes for Lucius Spar

Technip USA, Inc. has contracted Lankhorst Ropes to manufacture the polyester mooring ropes for a new spar platform for the US Gulf of Mexico.

The Lucius truss spar hull will be installed in a water depth of 2,165 metres (7,100 feet). The 23,000 ton spar is designed to produce 80,000 bopd of oil and 450 MMcfm/d of gas. First oil from the project is scheduled for 2014.

Lankhorst Ropes’ offshore rope production facility in Portugal will supply a total of 31,400 meters of their GAMA 98® polyester deepwater mooring rope with 1907tf (4200 kips) minimum breaking load. Production starts in January 2012.

Chris Johnson, sales director, Lankhorst Ropes Offshore Division, said, “We are delighted to be working with Technip again. The Lucius contract is testimony to Lankhorst’s well proven, high quality GAMA 98® product which is already installed on three Gulf of Mexico floating production facilities since 2008”.

This will be the 15th spar platform to be delivered by Technip out of 18 worldwide. Detailed design and fabrication of the new hull will be carried out by Technip’s Pori yard in Finland, where most of the previous Technip Spar projects have been manufactured. Project management for will be carried out by Technip in Houston.

Anadarko operates the Lucius field (35%), and its partners are Plains E&P (23.3%), ExxonMobil (15%), Apache (11.7%), Petrobras (9.6%) and Eni (5.4%).

Articles

- Norway: Lankhorst Ropes to Supply Mooring Lines for Goliat FPSO

- USA: Technip to Build Truss Spar Hull for Anadarko’s Lucius Development

- Technip Gets LOI for Lucius Field Development in U.S. Gulf of Mexico

- The Netherlands: Petrobras Selects Dyneema Fibers for MODU Mooring Ropes

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM

Related articles

- USA: Technip Bags Lump Sum Contract for Lucius Development Project in GoM (mb50.wordpress.com)

- USA: FMC Technologies Provides Subsea Systems for Anadarko’s Lucius Field (mb50.wordpress.com)

- USA: Aker Solutions to Provide Umbilicals for Anadarko’s Lucius Development (mb50.wordpress.com)

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM (mb50.wordpress.com)

- Lucius: Deepwater Gulf of Mexico (mb50.wordpress.com)

USA: Aker Solutions to Provide Umbilicals for Anadarko’s Lucius Development

Aker Solutions has been awarded a contract for eight steel tube umbilicals by Anadarko Petroleum Corporation for the development of Lucius offshore field in the Gulf of Mexico.

The company did not disclose the contract value.

The scope of work includes the project management, design, engineering, and manufacturing of two electro/hydraulic dynamic production umbilicals, two gas lift dynamic umbilicals, three electro/hydraulic infield umbilicals and one gas lift infield umbilical, including all associated ancillary equipment required for installation and interface with the existing development. These umbilicals will utilise the patented Aker Solutions PVC profile matrix, which provides both predictable estimates of fatigue and friction, and improved crush and impact resistance.

“This contract award is an excellent step towards our goal of supplying equipment for Anadarko across many product lines, including umbilicals,” says Tove Røskaft, executive vice president of Aker Solutions’ umbilicals business area.

Management, engineering and manufacturing of the umbilicals will be performed at Aker Solutions’ facility in Mobile, Alabama.

Final deliveries will be made in Q3 2013.

The Lucius field is located in the Gulf of Mexico approximately 275 miles (442 kilometres) southwest of Fourchon, Louisiana in Keathley Canyon (KC) Block 874, 875 and 919, in a water depth of approximately 7 000ft (2 100 metres).

Truss spar

Lucius will be developed with a truss spar floating production facility with the capacity to produce in excess of 80,000 barrels of oil per day and 450 million cubic feet of natural gas per day. The spar is currently under construction at Technip’s facility in Pori, Finland and will be the largest of Anadarko’s operated spars — a deepwater production solution pioneered by the company in 1997.

The Lucius unit includes portions of Keathley Canyon blocks 874, 875, 918 and 919. Anadarko operates the unit with a 35-percent working interest.

Co-venturers in the Lucius unit include Plains Exploration & Production Company with a 23.3-percent working interest; Exxon Mobil Corporation with a 15-percent working interest; Apache Deepwater LLC, a subsidiary of Apache Corporation with an 11.7-percent working interest; Petrobras with a 9.6-percent working interest; and Eni with a 5.4-percent working interest.

Articles

- USA: FMC Technologies Provides Subsea Systems for Anadarko’s Lucius Field

- USA: Mustang Secures Topsides Engineering Contract for Anadarko’s Lucius Field

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM

- USA: Anadarko, Exxon Mobil Finalize Lucius Unitization Agreement

- USA: Technip to Build Truss Spar Hull for Anadarko’s Lucius Development

Related articles

- USA: FMC Technologies Provides Subsea Systems for Anadarko’s Lucius Field (mb50.wordpress.com)

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM (mb50.wordpress.com)

- USA: Technip Bags Lump Sum Contract for Lucius Development Project in GoM (mb50.wordpress.com)

- Lucius: Deepwater Gulf of Mexico (mb50.wordpress.com)

- USA: FMC Technologies Inks Global Alliance Agreement with Anadarko Petroleum (mb50.wordpress.com)

- USA: Anadarko, Apache and Noble Energy Hire ENSCO 8505 Rig (mb50.wordpress.com)

- Anadarko has Gulf of Mexico discovery (mb50.wordpress.com)

USA: FMC Technologies Provides Subsea Systems for Anadarko’s Lucius Field

FMC Technologies, Inc. announced today that it has signed an agreement with Anadarko Petroleum Corporation to provide subsea systems and life-of-field services for its Lucius project.

The Lucius field is located approximately 275 miles southeast of Galveston in Keathley Canyon Block 875, in water depths of approximately 7,100 feet (2,160 meters). FMC’s scope of supply includes five subsea production trees and two manifolds. The equipment will be supplied from the Company’s operation in Houston and deliveries are expected to begin in the fourth quarter of 2012.

“Anadarko is the largest independent operator in the deepwater Gulf of Mexico,” said John Gremp, FMC’s Chairman, President and Chief Executive Officer. “We are pleased to continue supporting their projects as their preferred subsea systems supplier.”

Truss spar

Lucius will be developed with a truss spar floating production facility with the capacity to produce in excess of 80,000 barrels of oil per day and 450 million cubic feet of natural gas per day. The spar is currently under construction at Technip’s facility in Pori, Finland and will be the largest of Anadarko’s operated spars — a deepwater production solution pioneered by the company in 1997.

The Lucius unit includes portions of Keathley Canyon blocks 874, 875, 918 and 919. Anadarko operates the unit with a 35-percent working interest.

Co-venturers in the Lucius unit include Plains Exploration & Production Company with a 23.3-percent working interest; Exxon Mobil Corporation with a 15-percent working interest; Apache Deepwater LLC, a subsidiary of Apache Corporation with an 11.7-percent working interest; Petrobras with a 9.6-percent working interest; and Eni with a 5.4-percent working interest.

Related Articles

- USA: Mustang Secures Topsides Engineering Contract for Anadarko’s Lucius Field

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM

- USA: Anadarko, Exxon Mobil Finalize Lucius Unitization Agreement

- USA: Technip to Build Truss Spar Hull for Anadarko’s Lucius Development

- Technip Gets LOI for Lucius Field Development in U.S. Gulf of Mexico

Other articles

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM (mb50.wordpress.com)

- USA: FMC Technologies Inks Global Alliance Agreement with Anadarko Petroleum (mb50.wordpress.com)

- USA: Technip Bags Lump Sum Contract for Lucius Development Project in GoM (mb50.wordpress.com)

- Lucius: Deepwater Gulf of Mexico (mb50.wordpress.com)

- USA: FMC Technologies Wins Subsea Systems Contract from LLOG – Who Dat project (mb50.wordpress.com)

- USA: FMC Technologies Buys Remaining Schilling Shares (mb50.wordpress.com)

- Shell Perdido: The first full field subsea separation and pumping system in the Gulf of Mexico. (video) (mb50.wordpress.com)

- USA: Anadarko, Apache and Noble Energy Hire ENSCO 8505 Rig (mb50.wordpress.com)

USA: Technip Bags Lump Sum Contract for Lucius Development Project in GoM

Technip was awarded a lump sum contract by Anadarko Petroleum Corporation for the engineering, construction and transport of a 23,000 ton truss Spar hull for their Lucius project in approximately 7,100 feet (2,165 meters) of water depth in the US Gulf of Mexico, with first oil being scheduled in 2014. Lucius will be the seventh Spar Technip has delivered to Anadarko.

The Lucius truss Spar floating production facility will have a nameplate capacity of 80,000 barrels of oil per day and 450 million cubic feet of natural gas per day.

Technip’s operating center in Houston, Texas, will provide the overall project management. The detailed hull design and fabrication will be carried out by Technip’s yard in Pori, Finland.

This Spar will be the fifteenth delivered by Technip (out of eighteen worldwide) and thus demonstrates Technip’s leadership in Spars and our ability to provide solutions for ultra-deep water developments. This also confirms the expertise and track record of our Pori yard to deliver state-of-the-art platforms.

Related articles

- USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM (mb50.wordpress.com)

- Lucius: Deepwater Gulf of Mexico (mb50.wordpress.com)

- Norway: Technip Wins Two-Year Contract Extension for Pipeline Repair Services (mb50.wordpress.com)

- Shell Perdido: moving the spar into place (video) (mb50.wordpress.com)

- Gulf of Mexico: Vector Lands Cascade Chinook Field Job (mb50.wordpress.com)

USA: Anadarko, Partners Give Nod for Lucius Project in Deepwater GoM

Anadarko Petroleum Corporation announced that it, along with its co-venturers, have sanctioned the development of the Lucius project, located in the Keathley Canyon area of the deepwater Gulf of Mexico.

“We are very pleased to achieve this important milestone in the development of the deepwater Lucius project,” said Anadarko President and Chief Operating Officer Al Walker. “We expect Lucius to be among the most economic projects in our portfolio, as we plan to utilize ‘off-the-shelf’ technology and leverage our proven project-management skills in an area where we have extensive expertise. We estimate the Lucius unit holds more than 300 million BOE (barrels of oil equivalent) with relatively shallow and highly productive reservoirs that can be developed in a capital-efficient manner. Once completed, Lucius will establish important infrastructure in an emerging area of the Gulf of Mexico where we have identified additional prospects and opportunities. We expect to have an active drilling program in the unit beginning in 2012, and we look forward to working with our partners to achieve first production in 2014.”

Lucius will be developed with a truss spar floating production facility with the capacity to produce in excess of 80,000 barrels of oil per day and 450 million cubic feet of natural gas per day. The spar is currently under construction at Technip’s facility in Pori, Finland and will be the largest of Anadarko’s operated spars — a deepwater production solution pioneered by the company in 1997.

The Lucius unit includes portions of Keathley Canyon blocks 874, 875, 918 and 919. Anadarko operates the unit with a 35-percent working interest. Following the previously announced unitization agreement, Lucius interest owners entered into an agreement with the Hadrian South co-venturers, whereby natural gas produced from the Hadrian South field will be processed through the Lucius facility in return for a production-handling fee and reimbursement for any required facility upgrades.

Co-venturers in the Lucius unit include Plains Exploration & Production Company with a 23.3-percent working interest; Exxon Mobil Corporation with a 15-percent working interest; Apache Deepwater LLC, a subsidiary of Apache Corporation with an 11.7-percent working interest; Petrobras with a 9.6-percent working interest; and Eni with a 5.4-percent working interest.

Related articles

- Conoco Offers Highest Bid In Mexico Lease Sale (mb50.wordpress.com)

- USA: FMC Technologies Inks Global Alliance Agreement with Anadarko Petroleum (mb50.wordpress.com)

- USA: Anadarko, Apache and Noble Energy Hire ENSCO 8505 Rig (mb50.wordpress.com)

- Dolphin Drilling to Provide Two Drillships for Anadarko’s Mozambique Operations (mb50.wordpress.com)

- Anadarko has Gulf of Mexico discovery (mb50.wordpress.com)

- Anadarko Makes Substantial Gas Discovery Offshore Mozambique (mb50.wordpress.com)

- Dolphin Drilling to Provide Two Drillships for Anadarko’s Mozambique Operations (mb50.wordpress.com)

May 8, 2014 – Apache’s U.S. Gulf of Mexico subsidiary elected to sell off its minority interest in the Lucius and Heidelberg developments to a subsidiary of Freeport-McMoRan Copper & Gold Inc. for $1.4 billion. The deal also includes 11 primary term deepwater exploration blocks. Apache combined its deepwater and shelf technical teams in an effort to focus on subsalt and exploration opportunities in water less than 1,000 feet deep. Apache is divesting an 11.7% interest in Lucius and a 12.5% interest in Heidelberg. Its interest in the 11 primary term blocks range from 16.67% to 60%. The transaction is subject to customary closing conditions and is expected to close by June 30. None of Apache’s producing operations are involved in the sale.

May 8, 2014 – Apache’s U.S. Gulf of Mexico subsidiary elected to sell off its minority interest in the Lucius and Heidelberg developments to a subsidiary of Freeport-McMoRan Copper & Gold Inc. for $1.4 billion. The deal also includes 11 primary term deepwater exploration blocks. Apache combined its deepwater and shelf technical teams in an effort to focus on subsalt and exploration opportunities in water less than 1,000 feet deep. Apache is divesting an 11.7% interest in Lucius and a 12.5% interest in Heidelberg. Its interest in the 11 primary term blocks range from 16.67% to 60%. The transaction is subject to customary closing conditions and is expected to close by June 30. None of Apache’s producing operations are involved in the sale.

Continents of the World

Continents of the World