Blog Archives

INPEX Orders USD 2 bln FPSO from DSME (South Korea)

The second largest shipbuilder in the world, Daewoo Shipbuilding and Marine Engineering, Co, announces that it has received an order to construct a giant Floating Production Storage and Offloading vessel (FPSO).

The order comes from a Japanese oil giant, INPEX and is a part of the company’s Ichthys project, offshore Australia.

Daewoo made the announcement on the Korea Exchange, saying that the estimated worth of the project is $2 billion.

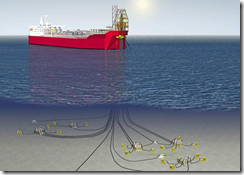

The FPSO will serve for offshore storage and export of condensate from the Ichthys field. The condensate will be transferred from the CPF to the FPSO and, further, it will be exported from the FPSO via a floating loading hose to offtake tankers.

The vessel will also treat and dispose of produced water. It will be located approximately 2 km from the Central Processing Facilitiy and will contain liquid (condensate and water) treatment facilities, living quarters and associated utilities.

South Korea’s shipbuilders have benefited greatly from the INPEX’s Ichthys project. Samsung Heavy Industries Co Ltd has recently received a $2.71 billion order for the construction of an offshore central processing facility (CPF) for the Ichthys project.

Related articles

- Australia: Heerema Wins Subsea Installation Contract for Ichthys Project (mb50.wordpress.com)

- Australia: Technip Wins Wheatstone Platform Design Contract from DSME (mb50.wordpress.com)

- Ichthys: The Largest Subsea Gig for McDermott (Australia) (mb50.wordpress.com)

- European Client Cancels Order, Says DSME (mb50.wordpress.com)

- Australia: Saipem Lands Ichthys LNG Work (mb50.wordpress.com)

- Singapore: Dyna-Mac Receives LOIs from Leading FPSO Operators (mb50.wordpress.com)

- Total and Inpex Launch $34 Billion Ichthys LNG Project Offshore Northwestern Australia (gcaptain.com)

- UK: Largest Contract in Odfjell Drilling’s History (mb50.wordpress.com)

BG Group Secures $1.8B for Brazilian FPSO Program

BG Group announced Thursday that it has received initial approval from the Brazilian Development Bank (BNDES) for up to $1.8 billion of long-term finance to fund part of the company’s interests in the pre-salt Santos Basin, offshore Brazil.

Subject to further approvals and the completion of a final agreement, the funding facility will be allocated to BG Group’s share of local procurement and construction costs for the eight floating production, storage and offload (FPSO) facilities that will be owned by BG Group and its Santos Basin partners.

The 150,000 barrels of oil per day capacity vessels are part of the wider first phase, fast-track development program in the Santos Basin that will deliver 2.3 million barrels of oil equivalent per day of capacity by 2017.

By the second quarter of 2012, BG Group expects to agree terms with BNDES on finance with a 14-year term.

“We are delighted to have received this initial approval from BNDES for long-term financing of up to $1.8 billion which will add to the diverse funding options already in place as we progress our global growth programme,” said BG Group Chief Financial Officer Fabio Barbosa.

“In particular, the funds will help underpin BG Group’s investments for the successful development of our world-class pre-salt Santos Basin interests. Finally, it also represents the support of one of the key players in the Brazilian government to our partnership with Petrobras and the country.”

Related articles

Angola: Total’s Usan Produces First Oil

French supermajor Total, operator of Block OML138, announces the start-up of production of the offshore Usan field in Nigeria, in line with the planned schedule. Usan is the second deep offshore development operated by Total in Nigeria, coming on stream less than three years after Akpo.

Discovered in 2002, the Usan field lies around 100 kilometers off the South East Nigerian coast in water depths ranging from 750 to 850 meters. The Usan development comprises a spread moored Floating Production, Storage and Offloading (FPSO) vessel designed to process 180 000 barrels per day and with a crude storage capacity of 2 million barrels. Its size of 320 meters long and 61 meters wide makes it one of the largest vessels of this type in the world. Development involves 42 wells that are connected to the FPSO by a 70 kilometers long subsea network.

Yves-Louis Darricarrère, President Exploration-Production at Total, stated on the occasion:

“I’m particularly proud to announce start-up of this major project together with the concession holder NNPC. This project demonstrates the ability of Total, a key operator of large-scale deep offshore developments in the Gulf of Guinea, to lead ambitious projects that will contribute to increase production for the Group and for the country. Total as operator has introduced a number of technological innovations, among which is a solution that drastically reduces gas flaring and thus minimizes the project’s environmental impact. The development of Usan has involved a record 60% of local content man-hours and thus has contributed to strengthening the know-how of the Nigerian industry in the area of hydrocarbon exploitation in the deep offshore.”

The Usan project has involved an unprecedented level of Nigerian local content, with over 500,000 engineering man-hours and 14 million construction and installation man-hours performed in Nigeria. FPSO construction included an offshore integration of 3,500 tons of locally fabricated structures. In addition, large-scale training and capacity building programs were put in place, raising the skills of the local workforce to the benefit of future projects.

Total’s wholly owned subsidiary Total E&P Nigeria Ltd. operates OML 138 with a 20% interest, while Nigerian National Petroleum Corporation (NNPC) is the concession holder. Total’s partners are Chevron Petroleum Nigeria Ltd. (30%), Esso E&P Nigeria (Offshore East) Ltd. (30%) and Nexen Petroleum Nigeria Ltd. (20%).

Offshore Energy Today Staff, February 24, 2012

Related articles

- Total starts production at Usan field in Nigeria (marketwatch.com)

- Usan Production Will Mitigate Yemen Loss, Nexen Says (mb50.wordpress.com)

- Geopolitical stakes in Nigeria: Curious role of the IMF (mb50.wordpress.com)

Singapore: Dyna-Mac Receives LOIs from Leading FPSO Operators

Dyna-Mac Holdings Ltd. , a provider of detailed engineering, procurement and construction services (“EPC”) to the offshore oil and gas, marine construction and other industries, has secured orders worth a provisional sum of S$115 million, boosting its order book to a provisional value of S$190 million as at to date.

The Group has signed Letters of Intent (“LOIs”) with leading operators of floating production, storage and offloading vessels (“FPSOs”), including Modec, Bumi Armada Berhad and SBM Offshore, for the fabrication of nine topside modules, nine piperacks and one turret. These offshore structures are for FPSO OSX 3, FPSO D1 and FPSO Quad 204 and the projects are expected to be completed progressively by the end of 2013.

UK, India, Brazil

According to the vessel’s owner, OSX 3 Leasing B.V.,FPSO OSX 3 will be deployed within the Campos Basin, offshore Brazil, on the Waikiki field upon completion.

Bumi Armada’s FPSO D1 will be chartered to India’s State-owned Oil and Natural Gas Corporation Limited (ONGC) and deployed in the D1 field, 200km off the west coast of Mumbai, India.

FPSO Quad 204 will be deployed in the UK North Sea and its turret design is a large internal mounted system with a bogie wheel bearing arrangement, which will moor the FPSO in harsh environmental conditions. The Quad 204 turret has a total weight of 10,000 tonnes and is provided with arrangements for connecting 20 mooring lines and up to 28 flexible risers and umbilicals. The turret topside structures consist of 5 decks and a gantry accommodating the process piping, manifolding, equipment and swivel stack for handling a total fluid throughput of 320,000 barrels per day.

Mr Desmond Lim Tze Jong the Group’s Executive Chairman and CEO, said: “We have been in talks for these projects, amongst others, for some time and we are very pleased to have finally sealed these projects, which boosts our current order book to S$190 million. Our tender book remains healthy and we are confident about our growth outlook given that current market dynamics continue to encourage higher spending on exploration and production of oil. Our optimism is also supported by Dyna-Mac’s strong track record and reliable reputation as a FPSO / FSO topside module specialist among our customers, many with whom we have entrenched working relationships.”

115 million Singapore dollars = 88.27814 million U.S. dollars

190 million Singapore dollars = 145.85084 million U.S. dollars

Related articles

- Modec Receives FPSO Order from Petrobras, Brazil (mb50.wordpress.com)

- Israel: DSME Signs Tamar Deal (mb50.wordpress.com)

- Worldwide: Project Field Development News (mb50.wordpress.com)

- Ship Photo Of The Week – FPSO Positioning (gcaptain.com)

- Norway Approves Brynhild Field Development Plan (mb50.wordpress.com)

- NZOG Acquires Stake in Cosmos Concession Offshore Tunisia (mb50.wordpress.com)

- Australia: All Ichthys Approvals on Track, INPEX Says (mb50.wordpress.com)

- Keppel Shipyard Lands $142 Million In Conversion Contracts (gcaptain.com)

- Petrobras Announces New Discovery in Carioca Area, Offshore Brazil (mb50.wordpress.com)

Hoegh LNG, DSME to Work on LNG FPSO for Israel’s Tamar Field

Höegh LNG Holdings Ltd. has entered into an agreement with South Korea’s Daewoo Shipbuilding & Marine Engineering Co. (“DSME”) to start a project specific front-end engineering design (FEED) of an LNG FPSO solution for the Tamar gas field offshore Israel.

This agreement follows the recent announcement of the agreement between DSME consortium, DSME and its Norwegian joint venture D&H Solutions AS and Tamar field owners, Noble Energy, Delek and Isramco to exploit part of the Tamar field by use of an LNG FPSO.

The agreement states that Höegh LNG with selected partners shall be the owner and operator of the LNG FPSO and that DSME shall be the EPCIC contractor, subject to further engineering work and a final investment decision.

President and CEO, Sveinung Støhle, says: “We are excited about initiating the engineering work for an LNG FPSO to monetize the gas reserves in the Tamar field in Israel based on Höegh LNG’s already developed design. This is a result of Höegh LNG’s continuous effort over the past five years to promote technical and economical sound floating solutions for LNG production. We are pleased to work with DSME and the Tamar field owners in jointly developing one of the first LNG FPSOs to come to market. DSME has been our partner for several years and we are confident that together with the other Tamar partners we will design, construct and operate an excellent solution for bringing the Tamar gas to the market.”

Tamar gas field is located some 80 km west of Haifa in waters 5,500 feet (1,700 m) deep. The gross resource estimate of Tamar has been increased to 9 Tcf from 8.4 Tcf as a result of appraisal work, Noble Energy said recently in a press release.

Related articles

- Israel: DSME Signs Tamar Deal (mb50.wordpress.com)

- Höegh LNG and Perushaan Gas Negara to Provide FSRU to Northern Sumatra (gcaptain.com)

- Floating LNG Off Israel? DSME Signs Initial Agreement (gcaptain.com)

- DSME Begins Construction on World’s Largest Floating Dock (gcaptain.com)

- Australia: Technip Wins Wheatstone Platform Design Contract from DSME (mb50.wordpress.com)

- Australia: All Ichthys Approvals on Track, INPEX Says (mb50.wordpress.com)

- European Client Cancels Order, Says DSME (mb50.wordpress.com)

Usan Production Will Mitigate Yemen Loss, Nexen Says

Government of Yement today informed Nexen that the company’s application to extend the Block 14 (Masila) Production Sharing Contract has not been accepted, and that a newly Yemen national company will take over the operatorship of the block upon the PSC expiry on December 17.

Marvin Romanow, Nexen’s President and CEO said: “While we’re disappointed we did not receive an extension, we’re proud of the accomplishments we’ve achieved there. Our operations at Masila have generated significant value for our company, enabling us to deploy the cash flow to build our current portfolio of legacy assets.”

Nexen explained on its website that decrease in the company’s all round production volumes as a result of the contract expiry will be reduced by the start-up of the Usan project, offshore Nigeria, which is expected to begin production in the first half of next year.

The Usan field was discovered in 2002 and is located some 100 kilometers offshore in water depths ranging from 750 to 850 meters. The field development plan includes a floating production, storage and offloading (FPSO) vessel with a storage capacity of two million barrels of oil.

Related articles

- Nexen Inc. could see end of Yemeni operations – Calgary Herald (calgaryherald.com)

- Ship Photo Of The Week – FPSO Positioning (gcaptain.com)

- Yemen Crisis Situation Reports: Update 107 | Critical Threats (theromangate.wordpress.com)

- Nexen’s $3.3-billion North Sea project gets approved (calgaryherald.com)

- Nexen’s profit up slightly, cuts 2011 production (business.financialpost.com)

Norway: Aker Proposes Aker Floating Production Acquisition

Norwegian conglomerate Aker said on Monday it was offering to buy Aker Floating Production , which owns and operates two ships that can produce oil and gas at offshore fields.

Aker, which already controls 72.3 percent of Aker Floating Production through a majority-owned investment firm, did not give a value for the transaction.

“Aker proposes a merger with Aker Floating Production in order to strengthen the FPSO (floating production storage and offloading) company’s balance sheet,” it said in a statement.

Aker said minority shareholders in Aker Floating Production would be offered settlement in Aker shares, and it would purchase some 115,000 Aker shares in the market for this purpose.

Reporting by Oslo newsroom (Reuters)

Related articles

- Norway-based Aker Solutions Increases its Middle East Presence with X3M Acquisition (mb50.wordpress.com)

- Re-inventing subsea intervention to keep economics above water (mb50.wordpress.com)

- Norway: Det Norske Pens Important Jette Field Deals (mb50.wordpress.com)

Brazil: Dresser Rand to Equip 8 FPSOs with Compression Equipmen

Dresser-Rand Group Inc. , a global supplier of rotating equipment and aftermarket parts and services, has been awarded compression equipment and services valued at more than $700 million by TUPI B.V. (Petrobras 65% and operator, BG Group 25%, Petrogal Brasil S.A – Galp Energia 10%) and GUARA B.V. (Petrobras 45% and operator, BG Group 30% and Repsol-Sinopec 25%).

The equipment, which includes up to 80 DATUM compressor trains, will be installed on eight (8) “replicant” floating, production, storage and offloading (FPSO) vessels. Six of these vessels will be located in the Lula field (formerly known as Tupi) and two in the Guara field. Training, aftermarket services and two 10-year maintenance contracts are also included as part of the award.

According to Vincent R. Volpe Jr., Dresser-Rand’s President and CEO, “We are proud to announce this significant award, and, more importantly, appreciative of the confidence that Petrobras and its partners have placed in us to supply all the compression trains for all services on these eight FPSOs. We believe that this is a clear statement by a highly respected Client of their confidence in our Company’s technology, execution capability and ongoing technical and field support. The award for all of the compression trains on this project reflects our Company’s strength of offerings in the Upstream Segment, which we project will be the largest area of growth in the Oil and Gas markets in the coming years.”

According to Jesus Pacheco, Dresser-Rand’s executive vice president, New Equipment Worldwide, “We believe in the value proposition our technology can bring to our end user Clients in this market. On this program, we bring proven leading-edge technology to increase the throughput, maintainability and reliability of these key assets. Building on previous compression solutions we have delivered for the Petrobras Pilot I, II and III FPSOs, we again eliminated the need for additional topsides equipment, specifically, separate CO2 pumping systems, saving space and weight, reducing the complexity of the overall plant, while increasing reliability. As the sole solutions provider for all topsides compression equipment, we are able to ensure all services are fully integrated to optimize overall plant operability. In addition, we have also maximized standardization of spare parts, maintenance practices and control systems to reduce inventory and maintenance costs.

“It is also important to note the positive impact this technology has on making these assets more environmentally sustainable. Higher compressor efficiencies possible by the use of our DATUM product line reduce the carbon footprint of these FPSOs as they require less power to meet the specified duties. With higher efficiency, better maintainability and higher reliability, and a smaller carbon footprint, we directly contribute to reducing the life cycle costs of the assets, which makes our Clients more competitive in the markets they serve.”

Consistent with the Company’s commitment to support localization initiatives in its served markets, a high portion of added value on this program will be performed in Brazil. This will include sourcing, project management and engineering, further development of local service support capabilities and packaging in a newly planned facility in the Industrial Corridor near Sao Paulo, which will further expand the Company’s in-country service capabilities.

On September 6, 2011, Dresser-Rand disclosed that it had been selected as the supplier for all the compression needs of these FPSOs. However, at the time, the Company cautioned that any actual award remained subject to the approval of Petrobras’ Board of Directors and its Partners. Those approvals have now been obtained. More than $400 million and $70 million will be reflected in its third quarter 2011 New Units and Aftermarket bookings, respectively. The Aftermarket booking amount is consistent with the Company’s accounting policy to only book the portion of the Aftermarket orders that will be delivered in the first 15-months of long-term service agreements.

On the basis of this project the Company reiterates its guidance that the new unit bookings for 2011 may be at the top end of, or even exceed, the guidance previously provided of $1.4 to $1.6 billion.

Related articles

- Modec Receives FPSO Order from Petrobras, Brazil (mb50.wordpress.com)

- Keppel Shipyard Lands $142 Million In Conversion Contracts (gcaptain.com)

Continents of the World

Continents of the World