Blog Archives

USA: Societe Generale Says Cheniere Can Make Sabine Pass Export Decision After Fenosa Deal

Societe Generale today said that Cheniere Energy can take a final investment decision on phase 1 of its Sabine Pass LNG export project after it has yesterday signed a supply deal with Gas Natural Fenosa, Bloomberg reported.

“This latest deal should allow construction of the liquefaction facilities, two trains capable of producing up to 9 million tons a year, at Sabine Pass to commence in 2012”, Societe Generale said in a report.

Gas Natural Fenosa has yesterday agreed to buy 3.5 million tonnes per annum (mtpa) of LNG from Cheniere Energy. The first LNG deliveries are expected to commence in 2016.

Related articles

- Gas Natural Fenosa Deals with Cheniere Energy to Buy US Shale Gas Sourced LNG (mb50.wordpress.com)

- USA: Cheniere Enters into Contract with Bechtel (mb50.wordpress.com)

- USA: Total Close to Sign Sabine Pass LNG Deal (mb50.wordpress.com)

- Chesapeake CEO Opposes US LNG Exports (mb50.wordpress.com)

- USA: Cheniere, BG Ink LNG Sale and Purchase Deal (mb50.wordpress.com)

USA: EPL Increases its Stake in Core Main Pass Area

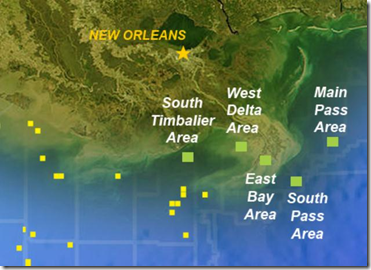

Energy Partners, Ltd. yesterday announced it has executed a purchase and sale agreement to acquire oil and natural gas assets in the shallow-water central Gulf of Mexico (GOM) from a subsidiary of Stone Energy Corporation for $80.0 million.

The transaction involves additional interests in the Main Pass (MP) 296/311 complex that was included in the assets EPL purchased from Anglo-Suisse Offshore Partners, LLC (ASOP) in February 2011, along with other unit interests in the MP complex and an interest in a MP 295 primary term lease. The assets are currently producing approximately 900 net barrels of oil equivalent (boe) per day, about 96% of which is oil. EPL estimates the proved reserves as of the November 1, 2011 effective date totals approximately 2.6 million boe, consisting of 96% oil and 100% proved developed producing. The Company also estimates the asset retirement obligation to be assumed in the acquisition is expected to total approximately $4 million.

Gary Hanna, EPL’s President and CEO commented, “The original ASOP property acquisition was an excellent transaction for EPL, and the acquisition announced today will more than double our interests in the MP complex. This purchase adds another layer of long-lived oil production to our current asset base, and additional upside without incremental overhead. We plan to increase our activity levels in this prolific area that we believe holds untapped potential. Post transaction, we will maintain substantial liquidity through our expanded revolving credit facility and the generation of free cash flow. Today’s announcement is representative of the type of acquisition we seek as an acquirer of quality assets in the central GOM.”

EPL intends to fund the acquisition with cash on hand, currently estimated to be in excess of $90 million. Additionally, the Company has worked with its lenders to expand the borrowing base under its undrawn senior secured credit facility from $150 million to $200 million, which maintains substantial liquidity for the Company. EPL has begun implementing additional oil hedges to provide further downside protection in conjunction with the acquisition. The purchase is subject to preferential rights-to-purchase held by the operator of the properties, and the closing of the transaction is subject to customary closing conditions and adjustments. The economic effective date is November 1, 2011, with closing expected in November.

Founded in 1998, EPL is an independent oil and natural gas exploration and production company based in New Orleans, LA and Houston, TX. The Company’s operations are concentrated in the shallow to moderate depth waters in the Gulf of Mexico focusing on the state and federal waters offshore Louisiana.

Continents of the World

Continents of the World